Review of Enron: The Smartest Guys in the Room

Introduction

Enron. This one word now evokes disgust whenever it`s uttered. But back in the 90`s, it was feted as one of the largest and most powerful companies in the world. Founded by Ken Lay and led to a large degree by Chief Executive Officer Jeff Skilling, Enron became the 7th largest US corporation and was named as `most innovative company in America` by influential Fortune magazine in 1994.

But just what did Enron do? Everyone knew of them, but very few understood what it was they actually did. Skilling summed it up best when he said that Enron "created markets that did not exist". We take it for granted now, but Enron pioneered the buying and selling of oil, gas and electricity. They weren`t bothered that they didn`t actually own any of it, they found a way to make money, lots of money, from it.

They were hugely successful and they traded on the only thing they had: their stock price. Enron`s stock soared as it looked as if their financial results were going through the roof, but they hid a major secret. Enron`s accounts were doctored in the most serious way, all thanks to a major new idea by Skilling. Traditionally balance sheets were only allowed to post profits once they had come in, but Skilling found a way around this. He came up with a new and dynamic way of reporting profits, called `mark to marketing`. This method, which was endorsed by their accounting firm at the very least, meant that Enron could post future profits as soon as they signed a deal. Therefore if an Enron executive signed a deal that was theoretically worth $10 million over 5 years, the entire profit could be posted the second the deal was signed.

While this may look very attractive to many people running businesses and needing to secure capital for future investments or direction, it is a false economy as companies stand or fall on what they actually do rather than what they might do. Still, Enron kept this charade up for many years until it all became too much and filed for bankruptcy on 2nd December 2001. On this day 4,500 employees lost their jobs and many thousands of people lost their retirement savings (quite similar to all those affected by Gordon Brown`s windfall tax actually) and end up with nothing for years of hard work and saving.

Typically, those at the top stated that they were blameless, other than pointing the finger at former vice president Andy Fastow, who put together a number of companies and channelled money through them. Putting together a complex network of dummy companies, Fastow enabled Enron to hide their losses to a large extent whilst also skimming money off the top in `management fees`.

One of the major scams pulled by Enron was the electricity crisis in California in 2000/2001, where despite producing it`s own electricity the state was woefully short of power for its own citizens. This was down to the deregulation of the market and which allowed the likes of traders working for Enron to manipulate it in order to make vast sums of money. In a quite callous way, these traders would ensure that various power plants were shut down for a period of a few hours in order to bump up prices. This was despite real people being affected and the lights going off all over California. This action eventually led to the ousting of State Governor Gray Davis by Arnold Schwarzenegger.

There is so much more to this story than I can do justice here, and the documentary by Alex Gibney lays it out bare. No taking sides like Michael Moore, just all the facts and the timeline put on the table. The film itself is based on the best-selling book by Bethany McLean and Peter Elkind, the former being the Fortune magazine reporter who started the fall of the Enron empire by simply asking if the stock was overpriced.

This documentary was nominated for an Oscar at the 2006 awards, pipped to the post by La Marche De L`Empereur.

Video

Nice visuals for a documentary. Lots of deliberately reflective shots that hint at the smoke and mirrors strategy that encompassed Enron. A couple of nice aerial tracking shots as well, particularly of the oil field at night - very impressive.

Audio

5.1 mix that isn`t that loud, other than the studio animation at the start which is unbelievably loud. Good subtitling on the main feature as well.

Features

Commentary - very informative and hints at what could have been included if he hadn`t reigned in his Peter Jackson-esque tendencies to do a three hour film.

Making Of - a look at the story behind the film and some interesting contributions

Deleted scenes - mixed in with already seen footage so you understand where they fit into the overall picture. No commentary on these and they are all lumped into one.

Trailer

Conclusion

Share prices and market share. Something that can either make you a lot of money or destroy you depending on how lucky you are. This is something I used to think. Now I`m more aware that the market can be manipulated by analysts who can recommend a buy and then make money off it by selling their own after the price goes up. Just think back to the Daily Mirror and the City Slickers scandal. That`s small fry compared to how the big boys do it though, politicians and corporate executives. They can`t do it all by themselves though, they need people to path the way or to turn a blind eye.

I used to work for a big US corporation as an Engineer/Engineering Manager and I remember the late 90`s and the obsession with both share price and dot coms. It dominated nearly everything with many staff encouraged to check the share price daily, despite the fact that share prices are built on a perception of what is a `good buy`. I can remember our share price reaching the heights of $70 a share before the bubble burst at around about the same time as Enron and plummeting to around $7 before I was made redundant from the company in 2002. I used to blame Gordon Brown for my misfortune (linked to yet another New Labour windfall tax, this time on GSM licences) but I wonder now how inextricably linked the bubble bursting was to Enron as well.

The Enron story is all the more incredible due to the fact that the corporation really did nothing. It manufactured no products and only sold things that it didn`t actually own. The whole thing was just one big house of cards and it only took one solitary journalist in Beth McLean to bring it all down, albeit with help from others. What is clear in this story is that it all comes down the basest of human qualities, the Gordon Gekko factor: greed. Greed may well have been good in the 80`s but it sowed the seeds to bring the whole thing down at the start of the new millennium.

The execs at Enron weren`t content with making shedloads of money, they wanted more. There is a little story contained within this documentary about an executive with a penchant for strippers called Lou Pai who left prior to the collapse of Enron (and therefore making him seemingly safe from prsoecution). Pai made approximately $23 million from selling Enron stock, and currently lives on a 77, 000 acre ranch in New Mexico as that state`s 2nd largest land owner.

Lay also made loads of money as the man at the top and in a completely ill-conceived move is shown at a press conference stating that he has every sympathy with those people who lost everything through Enron`s collapse as he and his wife had lost most of their $700 million fortune and were down to their last $20 million. Geez, I`m sure that was a real comfort to those people who now have to struggle in retirement. I`m pretty sure that even the recent death of Ken Lay will not console those people as it would appear that his money may well now be safe. Still if it concentrates the minds of those still tasked with prosecuting Jeff Skilling, then it has served a purpose.

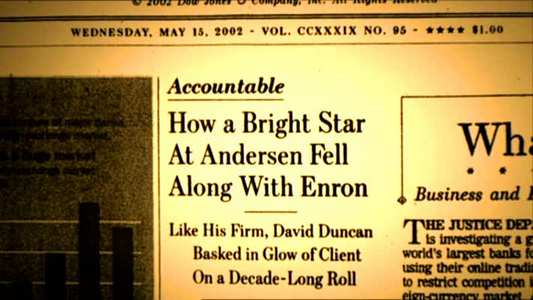

Alex Gibney states that the Enron story makes him angry despite the non-biased tone of his film. Well I`m angry too, and so should everyone-else be. This is one of those films that everyone should watch at least once and learn about vested interests and how people make money from manipulation and vested interests. Make no mistake, Enron didn`t do this on their own. They had help, notably from giant accounting firm Arthur Andersen who went down with them. There were a lot more people involved in this whole saga though, both in business and political circles. There were also people who were pressured into believing that they were not as smart as those they questioned, basically bludgeoned into accepting the `truth` presented by Enron.

Now I am a blue-blood Conservative with a capital C. I don`t hate capitalism and I believe that if you work hard then you should be rewarded. What I don`t like is how people use capitalism as an excuse for skewed ethics in the pursuit of lining their own pockets. Not that Communism, on the other side of the coin, is any different when you look at how the upper echelons of the former Soviet Union lived compared to the majority of its citizens. Still, that argument is for another day. Corporations and businesses, large or small, are here to make money. That`s a good thing. Greed is a bad thing. Watch this film and watch greed in action. Then think back to the pension scandal of the 80`s of Mirror owner Robert Maxwell. Think of the vast sums of money made in football today and how it is made. Greed is all around and the money is made off the backs of ordinary people.

Make no mistake, this is not the end. Enron weren`t the first and they won`t be the last. I don`t need a degree in economics to foresee that…

Your Opinions and Comments

Be the first to post a comment!